Most couples are not always honest when it comes to the issue of money. A study in the U.S by Creditcards.com found that nearly 1 in 5 customers have hidden purchases of $500 or more from their partners, they also found that almost 7.2 million people have concealed a bank or credit card account from their partners. There is no surprise then that spending decisions are a major reason for most relationship troubles, one partner wants to save and tries everything to cut on costs while the other partner just likes to spend and if allowed, spend enough money each month that will exceed the household budget and put the family in debt.

Say you are the financially responsible partner in the relationship, you buy a beat up ’95 Honda Civic, but your spouse drives the latest luxury car. You go to the mall and buy just what is necessary, but your partner comes home with a few of the latest gadgets just for fun. You are working hard to save every penny, but your partner is spending cash as if it grew on trees.

Listed below are a few steps you can take to stop your partner from blowing all the household savings on irrelevant things and start saving today.

How to Stop your Spouse from Spending Money

The Approach Matters

When you have an overspending partner, do not always approach in an accusing manner, this would put your partner on the defensive as you’ll likely either aggravate the matter or accomplish nothing. Do not accuse your spouse of wrongdoing or keep emphasizing out faults whether it is justified or not. This type of approach will only drive a wedge between the two of you and make it harder to communicate. Rather, approach the subject in a loving manner, sit your spouse down and respectfully explain the situation to them. A tactic that’s very useful is to bring up saving for something important, say retirement, the kids fees, for a house purchase or something, something that will make your spouse see reason to stop spending unnecessary. Again, do not approach as if it’s an attack, otherwise, your partner may resort to lying about spending money to you.

Set Dream Goals

Telling your partner not to overspend when there is always some money “available” is hard. The overspending partner sees this money and goes on spending thinking it’s free money. Set specific goals for your money. It is very hard for an overspending partner to save money just for fun. However, once goals are set, it will be much easier. Sit down with your partner and set dream goals you both can then work towards achieving. There should be a reason not to overspend, something to work towards. It can be getting out of debts, saving for retirement, saving for the kids, just a very important goal to look forward to.

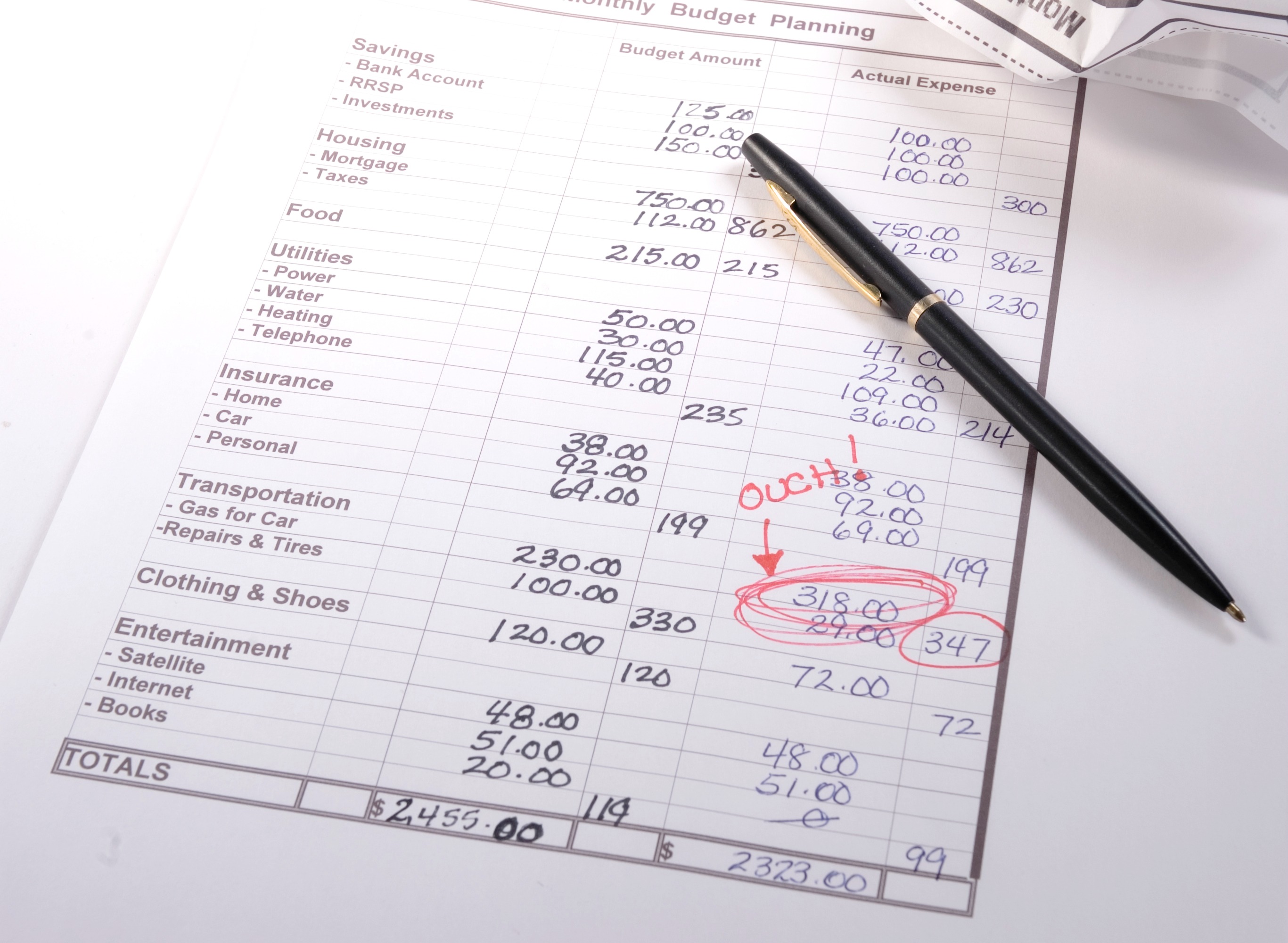

Have a Budget

Having a budget works wonders on an overspending spouse. If you are yet to make one, set one up together immediately. Work with your partner to figure out what your total income is and what your total expenses are too. Let your spouse know that there is no money and spending on unnecessary items would put the family in debt and keep you from saving up for your dream goals.

Set Aside Some Fun Money

When setting up a budget, do not tie every penny down to something, leave a few dollars free for spending, this is called “fun money.” This isn’t money to pay the bills, to make car payments, for groceries or to pay off debts, just a set sum that your overspending partner gets to have a bit of financial freedom with. This money can be spent without any restriction or questions asked, when the money has been exhausted, the partner has to wait until the next payday to spend again. This would prevent him/her from breaking into the family’s main account budgeted for the relevant things.

Hold Regular Financial Meetings

In each meeting, you talk about your goals again, and depending on what has changed, adjust your budget again. This helps your overspending partner know how far cutting down on excessive spending has helped the family and if not, how it is still hurting the family. These financial meetings are to monitor and discuss your progress. You may find that there is a regress some months, however, it’s likely that you will see an emerging trend of improving finances. This meeting time should also be used as an avenue to praise your partner and encourage him/her to keep working towards your collective goals.

Seek Counseling

If all the steps fail, or your partner is actively resisting all your efforts, it may be time for you to seek help from an outside source in the form of a counselor. Counseling would help uncover deeper issues that your partner is trying to cope with by overspending.

It’s important to know the benefits of teaching by example, you cannot overspend yourself and expect your partner not to do same. Make sure you set a good example and work just as hard as you expect your partner to.

Leave a Reply